The Bank of England’s move to step in and calm the chaos in financial markets follows turmoil for the pound and UK government bonds caused by the Chancellor’s tax-cutting mini-budget.

The Bank intervened to try to bring surging yields in government bonds – known as gilts – under control as they spiralled higher, sending UK public borrowing costs soaring.

It said it would buy bonds “on whatever scale is necessary”, but has so far resisted calls to deliver an emergency interest rate rise after the pound fell to an all-time record low against the US dollar on Monday.

Here we look at the reasons behind the Bank’s emergency bond-buying action and what it means for households and businesses:

– Why has the Bank stepped in and what is its move designed to do?

The Bank has announced plans to launch a temporary programme to buy gilts, effectively stepping in to provide a backstop in the market and halt a sell-off.

It made the move after the yield – or interest rate – charged on long-dated gilts soared to levels not seen for many years, which the Bank said threatened to see financial conditions tighten in the UK, cutting the flow of credit to households and businesses, if not addressed.

It is also understood that the Bank’s action follows concerns over the balance sheet strength of many UK pension funds caused by the gilt sell-off, with fears over their solvency if the rout continued unabated.

– What are bonds and bond yields?

Bonds are loans that investors make to a bond issuer and can be issued by companies or governments to raise money.

The yield on a bond is the amount of money an investor receives for owning the debt and is represented as a percentage of its price. When a bond price falls, its yield rises.

Yields fall when investors are less willing to own the debt, meaning they will pay a lower price for the bonds.

– Why are bond yields rising?

Concerns over Britain’s economic policies have sparked a gilt rout, sending the yield on 10-year gilts to over 4% – a level not seen since the 2008 financial crisis.

Government bond yields are under pressure worldwide amid fears over a global recession caused by the energy crisis.

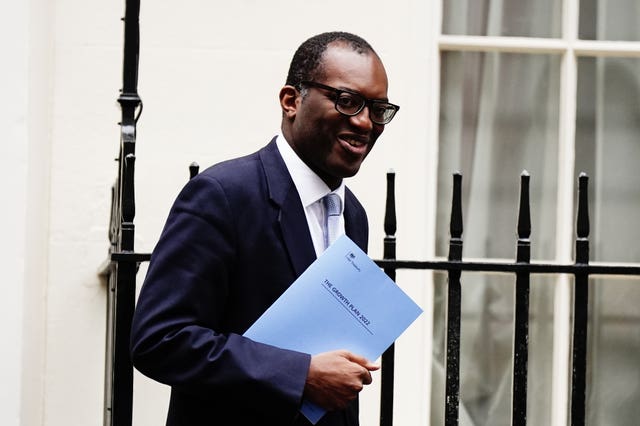

But UK government bonds have suffered more than most, with the market losing confidence in UK economic policy given Kwasi Kwarteng and Liz Truss’s moves to slash taxes with no plans to get public borrowing on a sustainable footing.

With the market set to be awash with gilts to finance the borrowing needed for the tax cuts, on top of energy bill support, gilt prices have tumbled further, sending yields soaring.

– Why are rising bond yields bad for the economy?

The yield on 10-year gilts is a proxy for the effective interest rate on public borrowing – meaning that rising yields equals higher borrowing costs.

Some experts said that the rises in gilt yields in recent days have added around £20 billion to the cost of the UK servicing its ballooning debt pile.

The Bank has this morning announced a gilt market operation. Full details can be found here: https://t.co/BvqFe9DZMp

— Bank of England (@bankofengland) September 28, 2022

Higher gilt yields also have a significant impact on mortgage lenders and they have been pulling loans at a record pace in response to market volatility and sharply rising yields.

A plunging pound can also cause a vicious cycle of soaring inflation, a higher bond yield and more expensive government borrowing, with interest rates hiked to try to tame the cost of living.

– Will the Bank’s action help households and businesses?

The Bank’s move has already helped trim yields on gilts and brought much-needed calm to the bond markets, also reassuring investors that it was willing to act outside of scheduled meetings.

But the pound is still close to record lows against the dollar and the Bank has made it clear it will likely have to hike interest rates significantly when it meets in November to rein in surging inflation.

This means borrowing costs are unlikely to come down anytime soon for households and businesses, with markets pricing in a rise close to 6% by next spring.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel