GREENWICH councillors at a budget meeting made a stark warning that benefit cuts could have "potentially devastating consequences" for families across the area.

April will see the system of council tax benefit scrapped and councils introducing support schemes with a 10 per cent cut in funding. It will see increased demands on families whose council tax is currently discounted or covered in full.

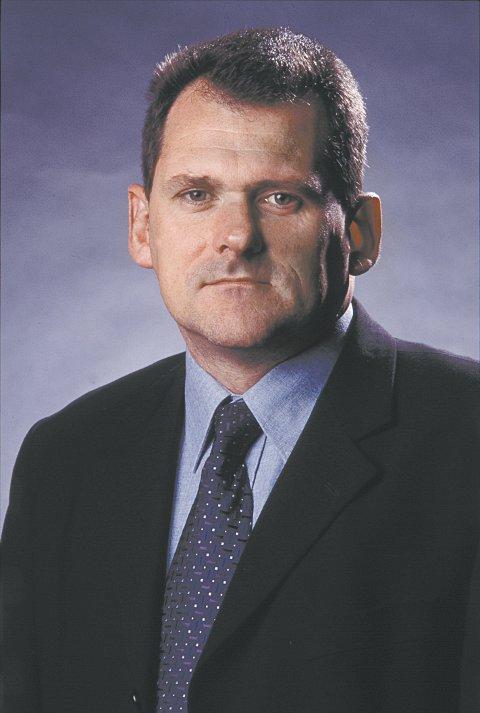

Leader of Greenwich Council Councillor Chris Roberts warned hundreds would face council tax bills for the first time, saying: "Families across the borough face potentially devastating consequences and it's not clear to me why the coalition should pick on families with children and the disabled."

Councillor Matthew Pennycook, whose Resolution Foundation research group reported on the effects of welfare reform this week, labelled the council tax changes "pernicious".

Welfare reforms will see a benefit cap of £500 a week for couples and families, affecting 450 households in the borough - nearly all of which have children - with 112 of them losing more than £100 per week.

An under occupancy cap on housing benefit will affect 4,140 households while 18,530 will be affected by council tax benefit changes.

Cllr Roberts said new investment programmes would include a £6m employment project, mainly providing jobs in parks, on the Cleansweep scheme, enforcement wards and town centre management.

He said: "Our proposal is to spend this premium on creating jobs in the main and to control the fallout over these benefit changes."

The budget will also see a council tax freeze, funding for a domestic violence support scheme along with £1.43m in cuts.

Alternative budget proposals by Greenwich Conservatives, including axing union payments and councillors' pensions, were rejected.

A radical proposal would have seen four area councils for the borough, with responsibility for running services and supporting businesses.

Conservative leader Councillor Spencer Drury said: "Our proposals would help local democracy, where power is isolated in the hands of a few individuals who seem to have a very Woolwich-based view.

"For instance, not a single Councillor from a ward south of Shooters Hill Road has had any power to make spending or taxation decision for the last eight years."

Warning over benefit cuts

A study by the Resolution Foundation independent research group found that some councils were planning to charge affected households an extra 20 per cent of the full council tax bill. Some households faced increases in bills of more than £600 a year.

Researchers warned that a variation in rates of council tax support could undermine the Government's new universal credit, which is meant to simplify the welfare system and ensure it always makes financial sense to take a job.

The report's author Councillor Matthew Pennycook said: "The axeing of council tax benefit has major implications for universal credit, which is supposed to be all about simplifying welfare and giving people a stronger incentive to work.

"These changes undermine both goals. There will now be a highly-complex and confusing patchwork of local support while the low-paid will keep even less of an extra pound in earnings than the Government has claimed."

Gavin Kelly, chief executive of the Resolution Foundation, said: "Millions of England's poorest households - both in and out of work - are already very close to the edge given falling wages, tax credits and benefits. Very few of those currently exempt from paying the full rate of council tax are expecting a large new bill to drop onto their doormat this spring.

"When it does, they are going to find it hard to cope. The new system will result in hard-pressed councils spending scarce resources chasing some of the poorest people in the country for non-payment."

Local government minister Brandon Lewis said: "Spending on council tax benefit doubled under the last administration and welfare reform is vital to tackle the budget deficit we have inherited. Under the last administration, more taxpayers' money was being spent on benefits than on defence, education and health combined.

"Our reforms will localise council tax support and give councils stronger incentives to support local firms, cut fraud, promote local enterprise and get people into work.

"We are ending the 'something for nothing' culture and making work pay. Under the last government, council tax bills doubled. The coalition Government has worked with councils to freeze council tax for two years, with a further freeze offered for this year. We are cutting council tax in real terms for hard-working families and pensioners, and we are on the side of people who work hard and want to get on."

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel